Marketing minds want to know: is there a paper shortage still? Out of the post-COVID landscape arose extremely tight paper market conditions, significantly impacting pricing. In this blog, we’ll look at the current state of the U.S. paper market as it pertains to direct mailers, and offer a glimpse into what 2024 is likely to have in store.

How we got here

The paper shortages that began in early 2022 were a direct result of super-accelerated, marketing-driven demand on an industry that:

- found itself significantly understaffed.

- largely shifted production to corrugated products.

- suffered the same domestic and import shipping challenges as everyone else.

The result:

- Sky rocketing prices on what little paper was available

- Reduced manufacturing capabilities to meet voracious demand

- Allocation-based fulfillment where requested amounts were not guaranteed

- Gridlocked sea ports, delaying imports entering the market

In response, paper buyers scoured the market, inventorying every scrap of print-grade paper they could find, making conditions ever tighter.

Is there a paper shortage today?

Luckily, paper availability has eased, albeit supply will not soon, if ever, return to pre-COVID levels. And while pricing has stabilized, it does not appear it will return to pre-COVID levels either. Today, much of the external pressures have resolved themselves. Shipping containers are readily available, and their prices have returned to pre-COVID levels. International shipping delays are more regional than systemic.

Further, we’re no longer in an allocation-based ordering market like we were in 2022. But the new “normal” looks to feature tight-but-not-strangling availability and prices remain high. Part of what is at play is a planned reduced paper manufacturing footprint that was in the works long before COVID arrived. So, today, paper manufacturers are in no hurry to increase capacity, as tighter conditions generate higher prices.

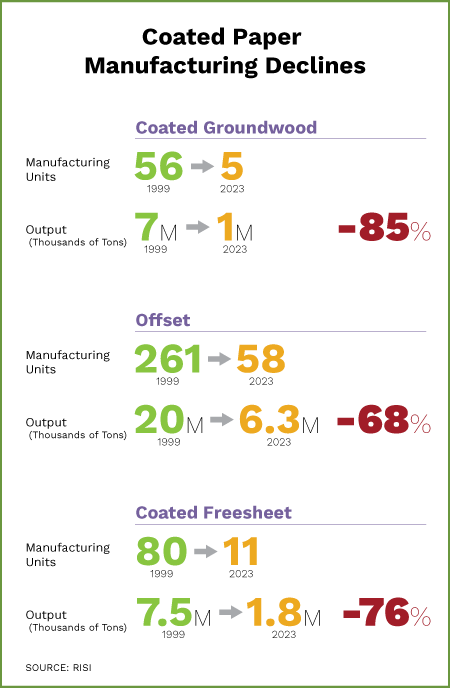

Coated paper manufacturing declines

Long-planned, pre-COVID capacity reductions by way of mothballing facilities and equipment remain unchanged. From 1999 to 2023:

Coated Groundwood

- Manufacturing units have decreased from 56 to 5

- Output has decreased from 7M to 1M (thousands of tons)

- Net decrease in output: -85%

Source: RISI

Offset

- Manufacturing units have decreased from 261 to 58

- Output has decreased from 20M to 6.3M (thousands of tons)

- Net decrease in output: -68%

Source: RISI

Coated Freesheet

- Manufacturing units have decreased from 80 to 11

- Output has decreased from 7.5M to 1.8M (thousands of tons)

- Net decrease in output: -76%

Source: RISI

Meanwhile, projections for U.S. corrugated demand indicate steady growth through at least 2030, further monopolizing equipment that previously produced mailing-grade papers.

Forecasting 2024

After COVID, printers stockpiled whatever paper they could get their hands on during the COVID-induced shortages. In 2023, they used that inventory while new orders declined from the atypical highs of 2022. This gave paper manufacturers room to catch up on inventories.

We believe that through the rest of 2024, paper ordering should return to normal. But, with a caveat. Should business needs sharply accelerate, we could see the return of overly tight markets due to reduced manufacturing capacities.