Financial Services

Achieve your campaign KPIs with data-driven campaigns and fast, accurate, secure execution.

Our focus throughout your campaign lifecycle is on improving results, from mid-tier community banks and fintechs to the country’s largest credit mailers. Sharpen the precision of your audience lists, leverage that data to hone communications, and execute complex content with ease.

Revitalize Invitations to Apply

The SG360° data science team leverages in-house credit-related data to find the prospects most likely to qualify and respond to your invitation.

Get custom segments of those credit-worthy prospects, based on spending patterns, purchase history, life events, financial goals, and risk tolerance.

We then tailor your offers to each segment and reach them at the time they are most poised to respond.

That intelligence about your target personas also informs how to differentiate your financial offering from your competitors’ and maximizes your results. Don’t leave your imagery, offer, and copy to chance.

Our Identity Grid zeroes in on the exact marketing channels where individual audience members will be most receptive to your offer.

By applying data modeling to various creative and channel combinations, we identify the optimal, scalable campaign framework for the highest success rate to achieve your campaign KPIs.

Execute Securely

Our HITRUST r2 certification ensure your audience data and campaign assets remain safe and secure during the entire campaign process, from strategy development to analysis, and beyond.

of Finserv marketers receive their highest customer lifetime value from direct mail.

The Future of Direct Mail 2024, SG360°

Insightful Analysis Made Easy

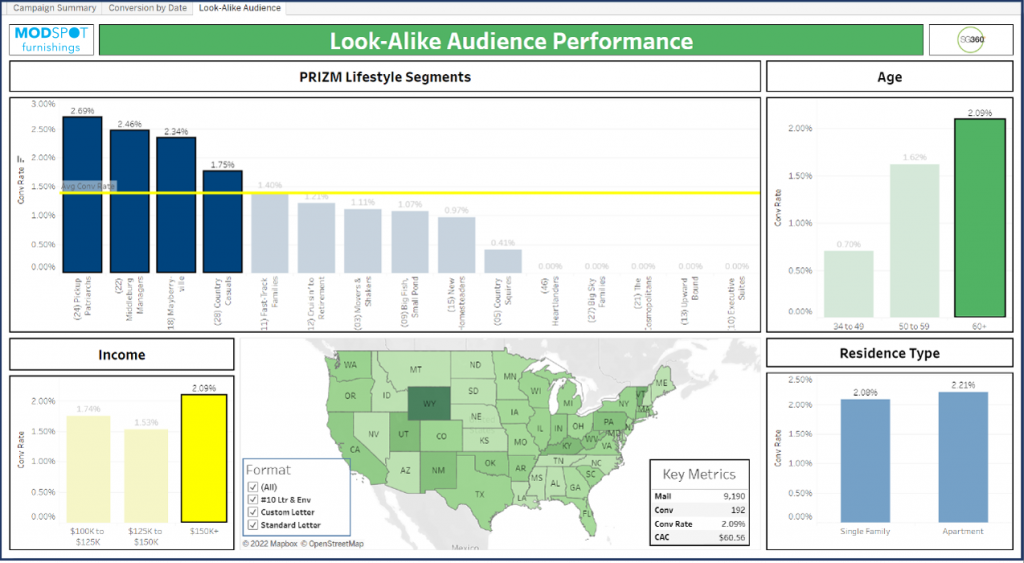

SG360°’s interactive ResultsTrackerTM puts sophisticated campaign analysis at your fingertips. Your own customized dashboard allows you to easily monitor your campaign’s specific KPIs in real time and view your results any way you’d like, in just a few clicks.

You can even run your own predictive analyses. Integrated with 5,000 data elements on 99.9% of all U.S. consumers, you’ll be able to simulate any campaign scenario to forecast potential outcomes.

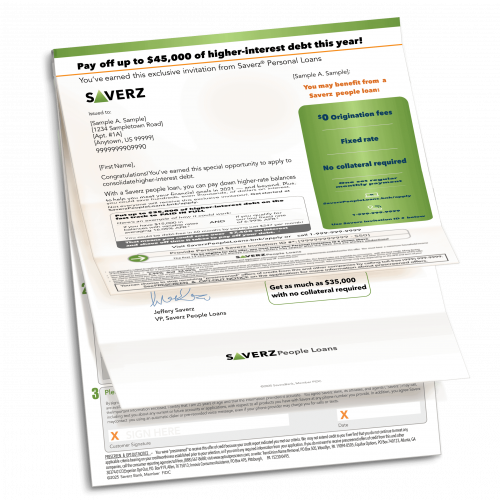

Case Study

Lender Offer Card

A format adjustment yielded 30% more loan conversions.